Why Misaligned Messaging Is Quietly Undermining Trust, Loyalty, and Growth

Author: Shayon Smith | Caribbean Brand & CX Strategist | Operational Excellence Consultant

Brand Isn’t Just a Logo—It’s a Promise

In the Caribbean’s evolving financial landscape, credit unions are more than financial institutions—they’re community anchors. But when brand alignment falters, even the most well-intentioned credit union can lose its grip on member trust, staff morale, and strategic growth. The cost? Quietly devastating.

Emotional Triggers: What Keeps Decision-Makers Up at Night

Whether you’re a CEO, Director, or General Manager, poor brand alignment triggers deep emotional and operational pain points:

| Trigger | Impact |

| Fear of Member Attrition | Inconsistent messaging erodes trust, driving members toward commercial banks |

| Frustration with Internal Silos | Marketing says one thing, frontline staff deliver another—confusion reigns. |

| Belief in Community-Centric Values | But the brand doesn’t reflect it, creating a disconnect between intention and perception. |

| Goal of Sustainable Growth | Yet brand misalignment blocks loyalty, referrals, and strategic partnerships. |

What Is Brand Alignment—And Why Credit Unions Struggle With It

Brand alignment means every touchpoint—from signage to service scripts—reflects your core values, mission, and member promise. Credit unions often struggle because:

- Legacy systems and outdated messaging dilute brand clarity.

- Staff training focuses on compliance, not brand experience.

- Leadership assumes “brand” is marketing’s job—not a strategic imperative.

The Hidden Costs: What You’re Losing Without Realizing

Poor brand alignment doesn’t show up on a balance sheet—but it bleeds through every KPI:

- Member Churn: Confused members don’t renew, refer, or engage.

- Staff Disengagement: Employees can’t deliver what they don’t understand.

- Reputation Risk: One misaligned moment can go viral—and not in a good way.

- Operational Inefficiency: Teams waste time reconciling mixed messages.

The Credit Union That “Looked” Modern But Felt Outdated: Are you guilty of this?

Today

Great work. Act a a leading Branding Consultant. You are writing a blog for yor website to help position you as the #1 Brand consultant in the Caribbean. You want to develop thought-leadership. The topic is: The Hidden Cost of Poor Brand Alignment in Credit Unions Your Focus Areas: • Emotional triggers: Fears, Frustrations, Beliefs, Goals • Target industries: Credit Unions, Hotels, Service-Based Businesses • Key decision-makers: o Tier 1: CEOs, Directors o Tier 2: General Managers, Managers Let’s ensure we have a blog that’s SEO optimized with the appropriate and relevant tags

Absolutely, Shayon. Here’s a compelling, SEO-optimized blog draft that positions you as the Caribbean’s go-to brand consultant—strategic, emotionally intelligent, and laser-focused on operational and cultural alignment.

The Hidden Cost of Poor Brand Alignment in Credit Unions

Why Misaligned Messaging Is Quietly Undermining Trust, Loyalty, and Growth

Author: Shayon Smith | Caribbean Brand & CX Strategist | Operational Excellence Consultant

Brand Isn’t Just a Logo—It’s a Promise

In the Caribbean’s evolving financial landscape, credit unions are more than financial institutions—they’re community anchors. But when brand alignment falters, even the most well-intentioned credit union can lose its grip on member trust, staff morale, and strategic growth. The cost? Quietly devastating.

Emotional Triggers: What Keeps Decision-Makers Up at Night

Whether you’re a CEO, Director, or General Manager, poor brand alignment triggers deep emotional and operational pain points:

| Trigger | Impact |

|---|---|

| Fear of Member Attrition | Inconsistent messaging erodes trust, driving members toward commercial banks. |

| Frustration with Internal Silos | Marketing says one thing, frontline staff deliver another—confusion reigns. |

| Belief in Community-Centric Values | But the brand doesn’t reflect it, creating a disconnect between intention and perception. |

| Goal of Sustainable Growth | Yet brand misalignment blocks loyalty, referrals, and strategic partnerships. |

What Is Brand Alignment—And Why Credit Unions Struggle With It

Brand alignment means every touchpoint—from signage to service scripts—reflects your core values, mission, and member promise. Credit unions often struggle because:

- Legacy systems and outdated messaging dilute brand clarity.

- Staff training focuses on compliance, not brand experience.

- Leadership assumes “brand” is marketing’s job—not a strategic imperative.

The Hidden Costs: What You’re Losing Without Realizing

Poor brand alignment doesn’t show up on a balance sheet—but it bleeds through every KPI:

- Member Churn: Confused members don’t renew, refer, or engage.

- Staff Disengagement: Employees can’t deliver what they don’t understand.

- Reputation Risk: One misaligned moment can go viral—and not in a good way.

- Operational Inefficiency: Teams waste time reconciling mixed messages.

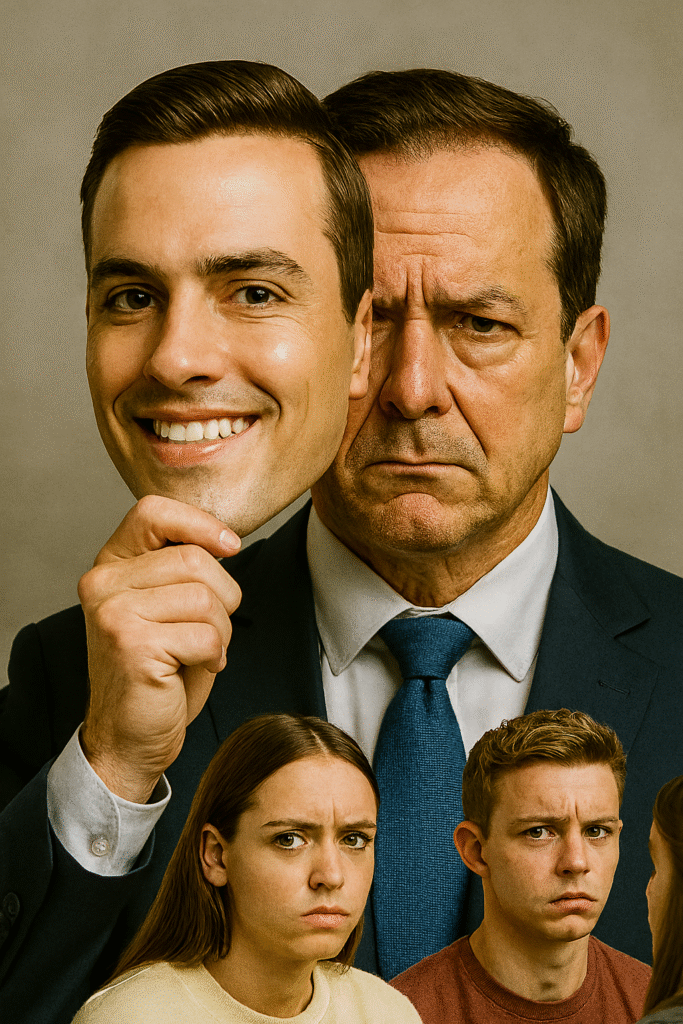

Case in Point: The Credit Union That “Looked” Modern But Felt Outdated

A mid-sized Caribbean credit union rebranded with sleek visuals and a new slogan. But frontline staff still used outdated scripts, and digital channels lagged behind. The result? Members felt the brand was “fake”—a facade with no substance. Member satisfaction dropped 18% in six months. As a matter of fact, the leadership never included the employees in the rebrand, never defined the core values to help “rally” the staff around it, and never reinforced the values through actionable behaviors and rituals.

How to Fix It: A Brand Alignment Blueprint for Credit Unions

Here’s how visionary leaders can realign their brand and reclaim trust:

- Audit Your Brand Touchpoints Map every member interaction—from onboarding to complaints—and assess alignment.

- Train for Brand Experience, Not Just Compliance Equip staff to embody brand values in tone, language, and behavior.

- Bridge Strategy and Culture Ensure leadership decisions reflect brand promises. Culture is the brand lived internally.

- Use Data to Drive Brand Decisions Track member sentiment, NPS, and engagement to refine messaging.

- Engage a Brand Consultant Who Understands Operations Branding isn’t fluff—it’s strategic. Partner with someone who blends CX, culture, and operational excellence.

Final Thought: Brand Is Your Competitive Advantage

In a region where trust is currency, brand alignment isn’t optional—it’s existential. Credit unions that align brand with culture, operations, and member experience will lead the next wave of financial transformation in the Caribbean.